What is Traditional Costing:

Traditional costing is the old method of coating used in companies. In this costing method, factory overheads are allocated according to product which depends on the volume of production resources utilize. Normally, applied depend on machine hours and labor hours. Main problem is that factory overhead is a huge amount as per the  allocation of basis so when a small change occurs in volume of resources than a big change appears in overheads. This type of problems normally faced when a huge production environment is development and big amount of overheads belong to them. Due to insufficient changes, there is no direct or smooth relationship between overheads and volume of resources. But traditional costing show good in financial reporting statement. Because simply overheads are apply to units produce at the ending inventory. No impact of management decision making perspective depends on this method of costing. (.accountingtools, September 30, 2015)

allocation of basis so when a small change occurs in volume of resources than a big change appears in overheads. This type of problems normally faced when a huge production environment is development and big amount of overheads belong to them. Due to insufficient changes, there is no direct or smooth relationship between overheads and volume of resources. But traditional costing show good in financial reporting statement. Because simply overheads are apply to units produce at the ending inventory. No impact of management decision making perspective depends on this method of costing. (.accountingtools, September 30, 2015)

What is Activity Base Costing:

Activity base costing is the new technique used in the method of costing. Activity base costing is simple related to activity base management. I this method, monitoring and costing of activities are happen which include resource consumption and then finally measure the costing of final output. Resources are belonging to activities and the cost of all activities is depending on the estimate of consumption. This method helps in improve asset utilization, lower the costs and increasing the efficiency. When the demand of activity is differ according to actions then it positively affect the profitability. Activity base costing is normally used in manufacturing industry. Less proportion of direct labor and material are consumed in productivity improvements and technological development but high proportion of indirect labor and overhead costs allocated. ABC is an alternative approach of traditional costing for the allocation of overheads on products, customers and services.

ABC system relate to overheads with all activities in the organization. Then allocate the costs of activities to all related products, services and customers. The most important and difficult portion of activity base costing is to analyze the activity. It is the process in which identification is happen of all output measure of activities and their resources and their effect on product making cost or services. Activity base costing give a special report to management for taking decision about selling, designing and transferring of product and its costs. Main point of ABC is that they focus on activities and their related costs. This method minimizes all costs distortion which appears in product costs. Different cost drivers are used to allocate costs of resources related to activities and unit costing is used for output measuring. Different ways are used to implement the ABC costing system. Some steps are given as: activity identified: analysis of each operating process which related to all responsibility centers and each center contain activities. According to activities assign all resources: determine the costs related to all cots objects like direct cost and indirect costs and general or administrative costs. Output identify: measure all the outputs related to all activities and resources utilize. Services, customer or product anything can be a output. Allocate the cots to output: activity drivers allocate costs of output depend on demand or consumption for activities.

The principles and policies of activity base costing apply same in all service industries, government agencies and manufacturing and process industries. ABC gives more attention on original cost of service, product, activities, customers and processes. With this organization attain detail understanding of process and cost behavior in ABC analysis. Management used all this information in decision making at operating and strategic level. ABC is consider as more accurate method for costing. It gives better and detail understanding of overheads and their causes. It clearly explains which activity is more costly and which one is less. It helps in management techniques like scorecard, performance management and continuous improvement.

Difference Between Activity Base Costing and Traditional Costing:

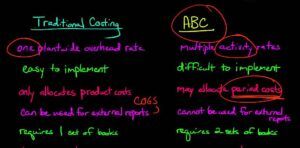

Traditional method of costing show an additional part of overheads as compare to direct costs for measuring total product costs. In traditional costing costs only distributed to non production and production costs. In production department all non production cots allocated. And all productions costs allocate to products or services. In normally depend on single volume measure like machine hours or labor hours. But this approach didn’t meet the cause-and-effect criteria in accurate cost allocation. With the increase in overhead costs this method provides inaccurate results which cause wrong decision making. (cimaglobal, Copyright ©CIMA 2006 )

In traditional costing systems, one rate used to allocate overhead, which depend on direct labor costs or labor hours. But problem is that now all products and manufacturing process become more complicated so no proper allocation of overheads cots happen on products and simple products become too difficult. In Activity base costing, overhead allocation approach utilize, allocate all costs on their activities and cost driver has direct relationship with resource consumption. ABC costing is used when we have different product as compare to volume and more complex manufacturing process. Product lines have different drivers and degree of support service they need. Overhead costs are a major portion of total costs. (.teicrete.gr/modules/document/file.php/TM149/ABC_example)

In the accounting field, traditional costing and ABC are two main and different methods used for cost allocation to products. In both methods, overhead costs are estimated according to production and then with the help of cost drivers assign these costs. Difference is occurring in the complexity and accuracy. Traditional costing is more simple method as compare to ABC and use average rate for allocation where as in ABC is more accurate than traditional because it indicate indirect costs with activities and then allocate the cost according to usage .

Traditional costing system allocated all indirect costs of production according to specified overhead rate. It treat overhead as a single entity. It is optimal when the indirect costs are low as compare to direct costs. In traditional costing, find out the indirect costs, estimate them in their period, select cost driver which related 5to costs, estimate the amount of cost driver according to specific period , measure the overhead rate which specified before and then spread all overhead costs to products.

Activity base costing is more accurate method of costing. Because it give precise distribution of indirect costs of productions. It’s more costly to implement and have more complexity in its procedure.

Traditional costing is a simple and easier to implement method as compare to ABC system. But traditional costing not gives us accurate results. It gives under costing or over costing in the specified results. (Wilkinson, July 23, 2013 i)

Companies require such type of accounting systems which proper track the costs according to operations. Traditional costing and ABC are two main costing methods.

Traditional costing cover average overhead rate in the manufacturing products to the direct costs. Overhead rates are determined according to cost drivers so they spread costs according to this way. It is best to use when overhead costs of company is low than direct costs. Then it give some accurate results when the volume of production is going high and any change in the overhead costs make a huge difference when measure the total cost of production. It is not too much expensive to use and implement. Normally companies use this method for external reporting because of its simplicity. But it not give an accurate and true picture to manager related to production costs because the overhead rate changes according to need and time and it not balance the cost of all productions. So overhead costs are charged to all those products which are not part of their production and related to overhead activities. This method is suitable for those manufacturers who only produce few products.

Activity base costing is totally different from traditional costing .it figure out all the overhead operations which are belong to manufacture of different products. Accountants use ABC to get accurate and exact results of all overheads. All products not need the overhead costs so overhead costs only apply where it used in the production of any product. Management wants to identify which is our actual profit and which elements reduce our profit without any reason. Activity base costing enhance the indirect costs which are belong to specific products. Traditional costing merge all over head in one point but ABC separately define all the overheads and their actual utilization. As we know this method is more accurate but this is very difficult in implementation and charge high cost . it is more suitable for those business that produce different products with high amount of overhead instead of those who offer services. That company use Activity base costing who produce a large number of products so it give them product costs of each product exactly and accurately. It helps in find out that area which is only a wastage for profit and disturb the amount of profit. (Woodruff, March 15, 2018)

ABC system was developing in 1981 whereas the traditional costing system develops and design in 1870 to 1920. In traditional costing, costs objects are used and resources are identified to measure the cost of product but in the activity base costing costs are depend on activities related to cost objects. Normally, activity base costing adopted by those companies who utilize a high amount of overheads and want more accurate and true results in the production sector. In activity base coating, different overheads are mention clearly which show that the contribution of each over head and utilization in the production area. Traditional costing consider all the overhead in the same heading and same head to production but this is not good because when some overheads are relevant and some are irrelevant than all costs effect our profit. Due to unnecessary overheads our profit going to decrease and at the end we get less profit. In this regard , activity base costing is best because it find out which overhead related to production sector and which is not then allocate all the costs according to their usage.

When any company set small targets, then it may be use traditional costing because it only hits its target but when company focus on attaining goals and with this also focus on their production costs and identify all the required overheads and all costs which occur during production then it use activity base costing which give results according to each activity and provide more accurate and correct results. (differencebetween, Copyright © 2018 Difference Between)

Conclusion:

Both systems have their own benefits and problems but it only depend on the company which company want what type of costing for sort out their costing issues and problems. Activity base costing and traditional costing both used for measuring the cost of production of all products used in the companies or manufacture in the company. Selection of method depends on the complexity of company’s structure and its cost drivers. Some companies adopt more complex method of production so they use activity base costing to allocate the original costs of each product on their required and exact places. Traditional costing consider all indirect costs are same so they charge all costs in the cost of production but this method also decrease our profit and not give sufficient profit in any case. So for getting more accurate and true results of production costing activity base costing is most suitable method but one thing is that high amount is required to implement activity base costing because it is very expensive and very difficult to understand so high qualified employees required to handle this costing method and give us true results.

References:

- accountingtools. (September 30, 2015). Traditional costing.

- teicrete.gr/modules/document/file.php/TM149/ABC_example. (n.d.). Activity Based Costing.

- cimaglobal. (Copyright ©CIMA 2006 ). Activity Based Costing . In T. C. Institute.

- differencebetween. (Copyright © 2018 Difference Between ). Difference Between ABC and Traditional Costing.

- Wilkinson, J. ( July 23, 2013 i). Activity-based Costing (ABC) vs Traditional Costing. strategiccfo .

- Woodruff, J. (March 15, 2018). Traditional Costing Vs. Activity-Based Costing. chron .